Real Estate

Premises Losses Are the Most Costly, Frequent Landlord Liability Allegations

June 28, 2023

A recent deadly apartment fire in New York has drawn attention to a landlord’s responsibilities in maintaining a property – and just how dangerous a negligent landlord can be.

The Bronx fire, which is one of the deadliest New York fires in decades, likely began with a faulty space heater. However, it was able to spread because the landlord had allegedly failed to ensure safety doors were self-closing and smoke detectors were functioning. This allowed smoke to pour into the stairwell, the tenants’ only means of escape.

In a lawsuit filed by survivors of the Bronx fire, tenants allege that the landlord knew of the unsafe and defective safety conditions in the building. According to the complaint, the landlords neglected fire escapes and electrical lines and did not have a sprinkler system installed. The lawsuit includes a $1 billion damage claim and an additional $2 billion in collective punitive damages.

Unfortunately, losses alleging negligence are not uncommon and can be quite costly, according to Advisen loss data.

Related Reading: Protecting Vacant Real Estate Property

Advisen Data

Advisen’s loss database contains more than 500 losses alleging similar types of landlord liability.

For example, a 2006 loss in the Bronx, in which tenants alleged their landlord didn’t provide a working smoke detector, resulted in one death and two severe burns. Prior to jury selection, the parties agreed to a $1.25 million settlement, according to Advisen.

Other landlord liability losses included allegations that landlords ignored apartment mold, leading to tenant illness; allegations the landlords ignored sidewalk defects and icy steps; and allegations that landlords failed to address lead paint, causing lead poisoning in children.

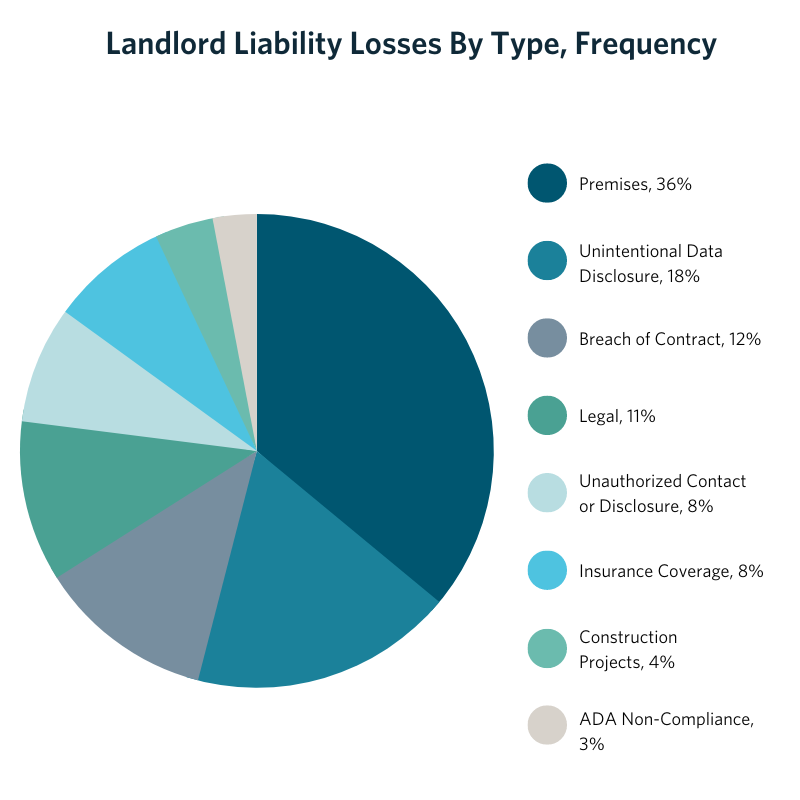

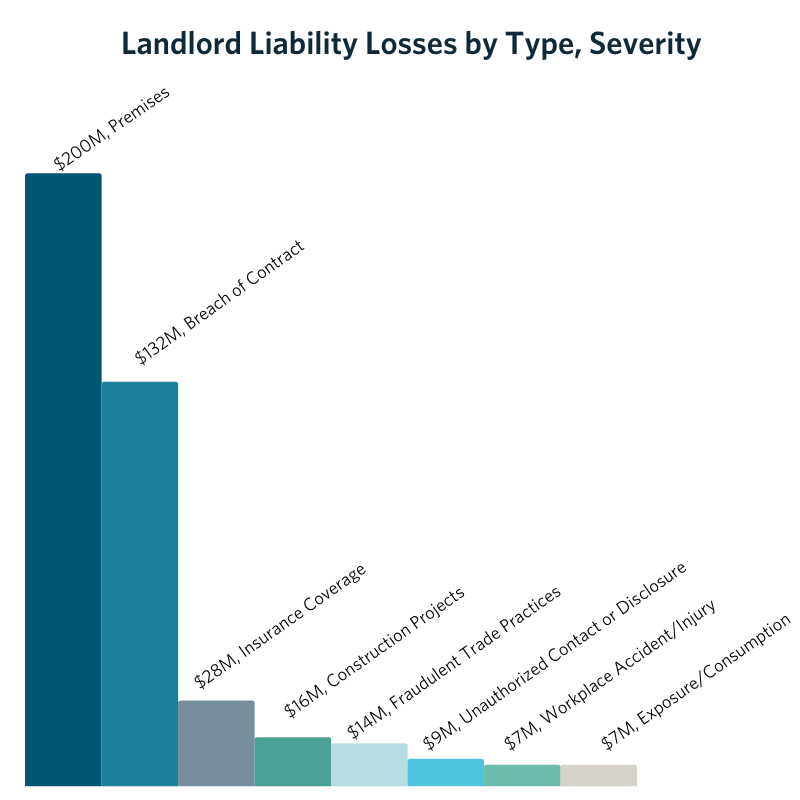

Looking at losses related to landlord liability,

premises losses were the most frequent, accounting for 36% of total losses.

These losses include negligence allegations like those mentioned above.

Unintentional data disclosure was the second most common type of landlord liability loss. According to the Advisen loss data, these losses include data breaches, landlords who sent out mass emails containing tenants’ or employees’ personal information, failure to properly dispose of confidential documents and mailing confidential documents to the wrong tenant. Breach of contract and legal losses are the next most frequent type of loss. Legal losses typically include disputes over leases, evictions or lease extensions.

Landlord Insurance

To protect against the potential of costly losses,

anybody considering renting out property should look into landlord insurance.

At a base level, landlord insurance typically covers personal injury on the

premises, physical damage and loss of rental income.

In addition to negligence, other landlord exposures include things they “should have known.” Dangerous pets, badly behaved tenants and dangerous property conditions fall into this category.

To avoid costly losses, landlords should keep a list of all complaints and repairs made on the property and inspect properties regularly to ensure debris, waste and flammable materials are properly disposed of. Landlords should also maintain safety equipment, including fire extinguishers, sprinkler systems and fire alarms; perform preventive maintenance on the property; and update plumbing, wiring and heating in accordance with applicable building codes and insurance carrier recommendations.

How Hylant Can Help

Owning or managing property comes with serious responsibility—and risk. Click here to learn how our real estate practice helps clients reduce liability and protect their investments.

The above information does not constitute advice. Always contact your insurance broker or trusted advisor for insurance-related questions.