Family Office Practice

Experience Managing Prominent Families

By Your Side At All Times

Hylant’s Family Office Practice specializes in assisting successful families and their family offices. We are proud of the work we have done since 2008 in managing some of the most prominent families throughout the world. Our team is accustomed to working with family office executives, personal business managers, family members and trusted advisor partners, such as wealth managers and attorneys.

We respond quickly and knowledgeably as your needs change, closing gaps that could put you at risk. Armed with our personalized service, executive insurance coverage summaries and 24/7 online access to your policies, you understand how—and how well—you are protected. And should a claim arise, your designated Hylant family office claims professional has the specialized expertise to protect you from unnecessary losses.

Coverages Unique to Your Circumstances

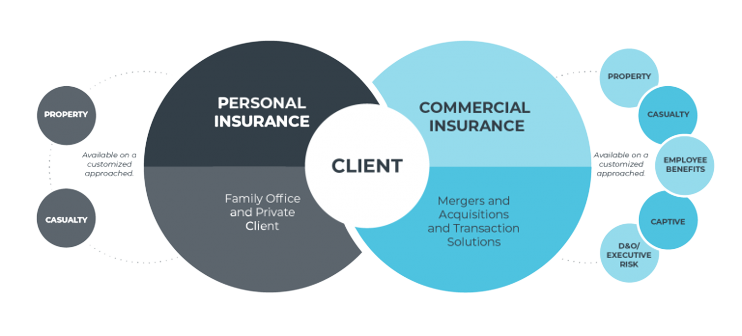

Protecting the assets managed by the family office is an art, as the risks can be vastly different for every family office structure. Our insurance professionals align an insurance portfolio with your personal and business assets, ensuring every detail is accounted for and managed appropriately.

We always start by first understanding your specific needs and conducting an in-depth analysis of family office assets and risks. Our family office services are outlined below.

- Homeowners insurance designed for high-value and multiple properties

- Auto insurance, including collector and recreational vehicles

- Watercraft insurance for various types of watercraft, including mega-yachts, high-performance boats and paid crew vessels

- Aircraft insurance

- Jewelry and collectible articles

- Umbrella liability coverage

- Life insurance

- Professional liability insurance to protect your family office

- Employment practice liability and workers’ compensation necessary to fulfill obligations as an employer of the family office staff

- Mergers, acquisitions and transactional risk consulting