RSM US LLP

Accounting for Climate Risks in Business Decisions

October 21, 2022

REAL ECONOMY BLOG | October 07, 2022

Authored by RSM US LLP

After a slow start, hurricane season has taken a significant toll in North America this year. Hurricane Fiona devastated Canada’s Atlantic provinces, leaving hundreds of thousands of people without power. Less than a week later, Hurricane Ian laid waste to vast areas of Florida and the Southeastern United States, resulting in $70 billion to $120 billion USD in damage.

The risk of hurricanes is nothing new. But their frequency and their toll are continuing to rise

The risk of hurricanes is nothing new. But their frequency and their toll, both human and economic, are continuing to rise.

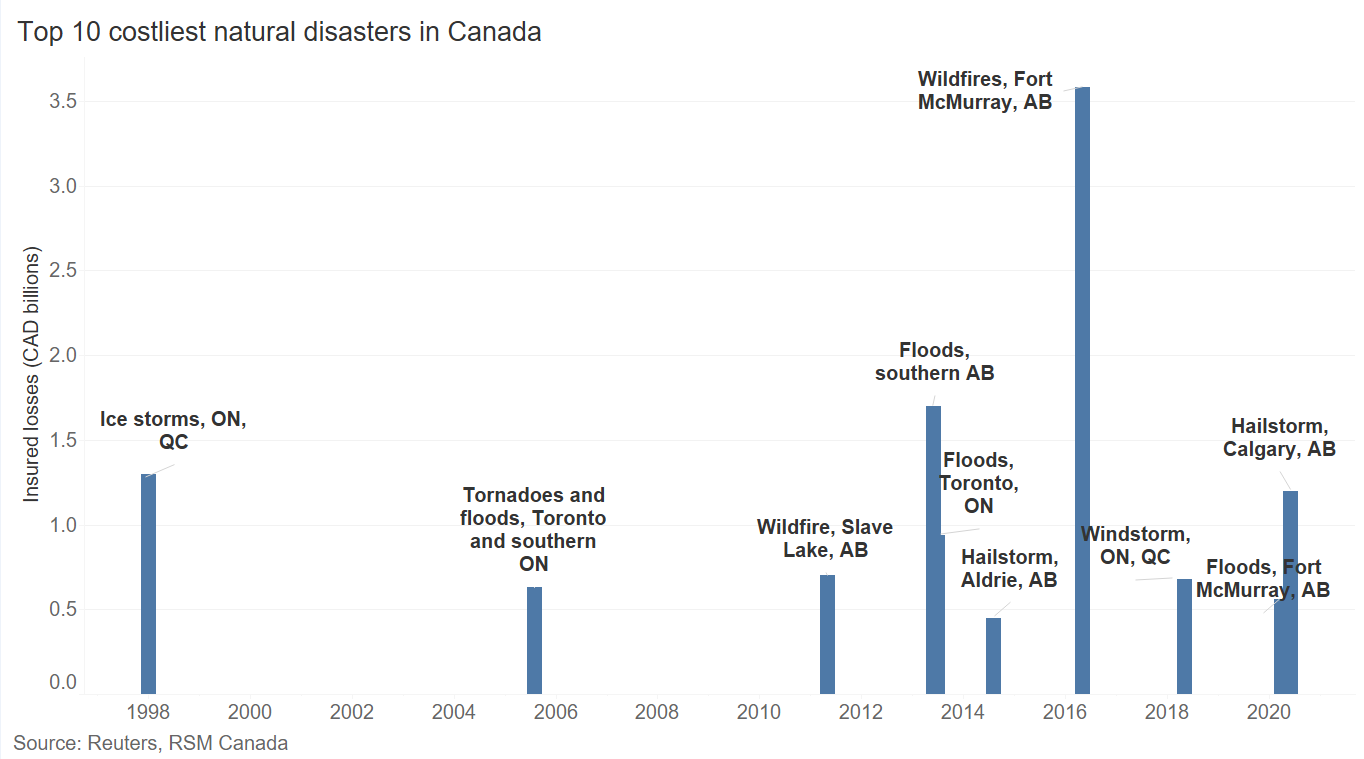

For businesses, it’s a phenomenon known as climate-related physical risks, and can be attributed in part to climate change, and also to the continued development of high-valued properties in disaster-prone areas.

When a hurricane, wildfire or flood hits, the cost of recovery and repair is that much higher.

Climate-related physical risks

The result is that businesses of all kinds must account for these risks and factor them into their strategic decisions. Few corners of the economy are immune, including agriculture, transportation, the supply chain and infrastructure.

No longer is extreme weather the concern of a limited number of coastal communities, or low-lying areas.

All investments have inherent risks, of course. But some risks are greater than others, and measuring these risks helps businesses determine their exposure and their level of resilience to emerging threats.

Identifying such risks also helps guide investment decisions, such as what to invest in, where to place those investments and when to do it.

With so much uncertainty surrounding climate change, it is important to conduct scenario analysis to understand the effect of each climate scenario on investment portfolios and business strategies.

For example, a company might decide to build a manufacturing plant in a different location after finding out that the first location would be at an elevated risk of flooding.

Climate-related physical risks also affect the value of assets because weather events can destroy physical capital. For investors, this means that borrowers might not be able to repay their loans.

Repeated events can lead to devaluations of real estate, even if they do not directly damage the properties. In addition, when extreme weather events occur, households and businesses draw on cash reserves and credit lines, which can affect liquidity.

All these should be accounted in investment and business strategies.

Insurance takes the lead

Even as many industries are starting to account for these risks, one industry has been on the forefront of incorporating climate change in business decisions: insurance.

Businesses and households rely on insurance to cover the cost of damage. When extreme weather events occur, insurance companies pay out claims, which often leads to higher premiums for everyone.

More and more, insurance companies are building climate-related physical risks into their models when calculating premiums or determining whether an asset can be insured.

For example, owners of houses with wood frames now pay higher premiums because of wildfire risks, while those in flood-prone areas have been paying increasingly high premiums for flood insurance.

Even getting a policy from a private insurer is not a sure thing; when the risks are too high, insurance companies might refuse to insure the asset altogether.

There is little surprise, then, that insurance companies have taken the lead not only in acknowledging climate risks but also in quantitatively factoring those risks into their business decisions.

After all, insurance companies have long investment horizons, and managing risks is the very backbone of insurance.

Accounting for climate risks

But other businesses have been slow to catch on, even though many have investments that are subject to climate risks.

Climate risks can be complex to assess and have a longer time frame. At the same time, many investors have shorter time horizons and are focused on the project at hand rather than macroeconomic implications.

Even financial institutions are still at the early stages of building capacity to assess climate-related physical risks. Similarly, few businesses quantify the impact of climate risks on their business strategies and investment portfolios.

But failure to factor in these risks can lead to suboptimal investment decisions with consequences on the return on investment, liquidity, as well as the viability of the business.

The takeaway

This year’s hurricane season, even after its slow start, has exacted a significant toll, both in loss of life and economic damage. Climate-related physical risks translate to expensive events that are expected to continue.

While there is substantial uncertainty and complexity associated with climate risks, ignoring them does not make the issue go away.

Rather, businesses must reduce their vulnerability to climate risks. This includes diversification, and, more importantly, understanding and quantifying these risks. Only then will climate risks be priced in and effectively managed in investment and business decisions.

This article was written by Tu Nguyen and originally appeared on 2022-10-07.

2022 RSM US LLP. All rights reserved.

https://realeconomy.rsmus.com/accounting-for-climate-risks-in-business-decisions/

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Hylant is a proud member of RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.

For more information on how Hylant can assist you, please call 800-249-5268.